Key Features

- Global strategy and tactics

- Seminars and collegiate courses

- Cross-functional decision-making

- Market entry and development

- Multinational competencies

- Team and leadership development

- On site, online and blended formats

- Prework for accreditation exam

Table of Contents

For those already familiar with our Capstone and Foundation simulations, CapsimGlobal builds upon their framework to take students from a domestic to a global marketplace. If you are new to our products, here is a quick catch-up.

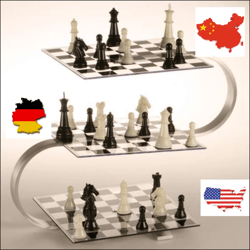

Capstone presents a domestic sensor manufacturing industry broken into five customer segments represented on a perceptual map. Customer expectations evolve over time, requiring competitors to evolve with the market. Compare it with chess.

Foundation, though rooted in the same industry, dials back earlier into the timeline to a point when there were only two customer segments. Compare it with checkers. It covers the same objectives, but the scenario is less complex and takes less time.

Chess and checkers use the same board. Capstone, Foundation, and CapsimGlobal use perceptual maps. Capstone places five segments on the map. Foundation and CapsimGlobal place two segments.

Now picture a 3D chess set. Replace the boards with perceptual maps. Deploy a two-segment map on the bottom map. That’s the USA. Above it we have Germany and China. Voila. CapsimGlobal. It is the cubic member of Capstone/Foundation/CapsimGlobal trio.

| Hard Skills | Soft Skills |

|---|---|

| Marketing | |

|

|

| Production | |

|

|

| Finance | |

|

|

| Strategy | |

|

|

Use Cases

CapsimGlobal is used in both corporate training and business school curriculums, albeit with different objectives and methods.

Corporations:

- Global Strategic Thinking: CapsimGlobal is a teaching platform designed to help managers transition from domestic planning to international strategic thinking. With options to expand into Germany and China, participants can learn how to navigate different market dynamics, cultural nuances, and regulatory environments.

- Cross-Cultural Leadership Training: The international context of CapsimGlobal allows for the development of cross-cultural leadership skills. Participants can learn how to manage a business across diverse cultural landscapes, understanding the challenges and opportunities of global leadership and team management.

- Market Expansion and Diversification: By starting in the USA and expanding into other countries, CapsimGlobal helps participants understand the complexities of entering new international markets, including evaluating market potential, adapting products and strategies to local preferences, and managing logistical challenges.

- Business Acumen Training: Managers in fields that do not require a business degree can quickly gain a holistic understanding of business operations in an international context. By managing different functional areas like marketing, finance, and production, they learn how their role fits into the bigger picture and how their decisions impact the company's performance.

- Strategic Planning and Alignment: CapsimGlobal is often used to get senior manager’s “outside the box” by placing them in a simulation designed to illustrate generic strategies, industry forces, and methods to achieve competitive advantage. From this external perspective, they can question long standing assumptions about their own business and open their minds to possibilities.

Business Schools:

- International Business Curriculum: CapsimGlobal is ideal for integration into international business courses. It offers students a hands-on experience in managing a business in a global environment, helping them understand the intricacies of international trade, foreign market entry, and global supply chain management.

- Global Business Case Analysis: The simulation presents various international business scenarios, challenging students to analyze global market data, adapt to different market segments, and make strategic decisions in an international context. This enhances their ability to think globally and act strategically.

- Understanding Global Market Segmentation: The simplified perceptual map with two segments helps students grasp the basics of market segmentation in a global context. They learn to strategize and position products effectively in diverse international markets.

- Curriculum integration: CapsimGlobal often appears near the end of a business degree program, where it pulls together concepts drawn from across the entire curriculum. It provides a bridge between theoretical knowledge and practical application. Students gain hands-on experience making strategic business decisions in a competitive environment. This allows them to test their understanding of business concepts, learn from mistakes without real-world consequences, and hone their analytical and problem-solving skills.

Commonalities:

Despite their differences in setting, both corporations and business schools use CapsimGlobal to present:

- Action Learning in a Global Context: CapsimGlobal engages participants in an active learning process where they make decisions for an international business, understand the impact of those decisions in different markets, and adapt strategies accordingly.

- Immediate Feedback in a Diverse Market Environment: The simulation provides immediate feedback on decisions, allowing participants to learn and iterate their strategies in a dynamic, international market setting.

- Competitive and Collaborative Learning: The competitive nature of CapsimGlobal, coupled with the need for collaboration in an international team setting, mirrors real-world global business challenges, enhancing learning outcomes and engagement.

- Leadership Development: CapsimGlobal can be used to identify and hone leadership skills. Participants work in teams to manage a virtual company, facing real-world challenges like market competition, resource allocation, and strategic decision-making. This practical experience allows them to develop critical thinking, communication, and collaboration skills, all while fostering a competitive and engaging learning environment.

- Teamwork and Collaboration: CapsimGlobal emphasizes teamwork and collaboration, requiring students to work together in teams to manage their virtual companies. This helps them develop communication, interpersonal skills, and the ability to navigate team dynamics, all valuable assets in any future career.

Overview

CapsimGlobal vs Capstone/Foundation: We should begin by contrasting CapsimGlobal with the Capstone/Foundation scenario. There are a few differences. In Capstone/Foundation product attributes revolve around Performance, Size, and Reliability. In CapsimGlobal they revolve around Speed, Accuracy, Service life, and Country kit. CapsimGlobal must deal with exchange rates and shipping costs. From a student’s perspective, if they played Foundation, then Capstone, then CapsimGlobal, they would easily transition from one to the next, but the issues and difficulty levels would increase with each step.

Scenario: The government has just broken up a monopoly into 3-6 identical companies. The monopoly masked many problems, ranging from inefficiencies to structural weaknesses. Teams are tasked with fixing these problems while building competitive advantages within a coherent business strategy. CapsimGlobal presents:

- A scenario that students can grasp quickly yet maps easily onto other industries.

- A “widget-like” product that will not spark preconceived ideas about the product or customers.

- Three functional areas - marketing, production, and finance. Decisions are set at the policy level.

- Cross-functional modules that require teams to think through the implications of their decisions in each functional area.

- Their company looks good on paper, but in truth the monopoly masked many problems.

- Three industry characteristics force teams to act: competition, industry growth, and technological change.

- A domestic starting point. As the simulation opens the companies are exporters. At most they advertise internationally, recruit foreign distributors, and seek high-volume international customers. In CapsimGlobal they can open subsidiaries in Germany, China, or both, with each new market presenting different risks and opportunities.

Delivery options: Both corporate seminars and collegiate classroom environments. In person, online, and blended formats. CapsimGlobal is a software as a service product.

Support: Instructor and student support. New instructors receive on demand training and support from our dedicated Customer Relationship Consulting group. Our CRCs train, coach, and support your delivery.

Editions: Tournament and Footrace. Both editions are ADA and GDPR compliant. Most LMS systems supported - free integration into unsupported systems.

Teams: Students are in teams that can be as small as three people or as large as seven with an ideal size of five. That said, there are exceptions. We have seen instructors create teams of upwards of 12 people, usually to work on organizational issues. If the student has previous experience with the simulation, the student can be promoted to CEO and manage the company alone. Footraces consist of one human team and five computer managed teams. Tournaments can consist of 2-10 human teams and up to four computer managed teams.

Industries: An "industry" consists of companies competing head-to-head. Companies can be managed by human teams or the computer, and instructors often configure industries to include both. The standard industry size is six companies, but instructors can configure the industry to accommodate up to ten companies. For the very small or very large class, the instructor sets up an industry for each human team that consists of one human team versus five computer "teams", with each computer team playing a distinct strategy. A typical class ranges in size from 12 to 70 students in one industry.

Rounds: Decisions are made in “rounds” which correspond to one year. Competitions last a maximum of eight rounds.

Easy delivery: CapsimGlobal is a computer simulation, and computers do grunt chores. They analyze, predict, process, print reports, share displays in virtual meetings, and prepare debriefs. Technical requirements are routine - a laptop and an Internet connection. Interfaces are designed to look like common business tools - spreadsheets, reports, email systems, and presentations.

- Corporate and academic venues

- Class sizes from 1 to over 1000 students

- 2-day workshops to semester long courses

- On site, online, and blended formats

- Developing soft skills and hard skills

Learning Objectives

CapsimGlobal offers a comprehensive array of learning objectives.

Strategic Analysis: Undertake detailed internal and external assessments utilizing frameworks such as SWOT, PESTEL, and Porter’s Five Forces.

Business Planning: Formulate an all-encompassing business strategy, considering elements like market positioning, competitive edge, avenues for growth, and international expansion.

International vs Generic Strategies: Demonstrate the ability to apply a strategy to a specific international market using local tactics adapted to the cultural and economic environment.

Cross-functional Decision Making: Exhibit decision-making proficiency across business sectors to address both immediate challenges and long-term strategic goals.

Performance Measures: Select key performance indicators, targets, and assessment methods to align and drive the company’s actions in accordance with the business strategy.

Implementation and Execution: Understand strategy complexities and devise methods to execute these strategies effectively.

Project Management: Design and implement projects to forge competitive strengths, encompassing various business functions.

Team Development: Understand the stages of team maturation and apply leadership tactics to optimize team performance.

Change Management: Understand organizational change dynamics and strategize to lead transitions effectively.

Communication with Stakeholders: Articulate the organization’s mission, vision, strategies, and decisions with clarity and precision, adapting the message to resonate with diverse audiences in both written and verbal forms.

Prework for an Accreditation Exam: Refresh knowledge, fill gaps, and hone skills developed during the degree program as preparation for an accreditation exam.

Similarities with Sibling Simulations

Our design philosophy is built around the concept, "Make the instructor's job easier." To use an analogy, if you rent a vehicle at a car rental, the controls look the same, but the vehicle's purpose can range from basic transportation to moving furniture. The driver can expect minor differences in the controls, but major differences in the application. All of our business simulations are teaching platforms, as opposed to business simulators (which are unique to an industry or company). Teaching platforms consider issues like "participant's technical vocabulary", "related conceptual spaces", and "delivery constraints". (See "Business Simulations: Bridging Theory and Practice for Transformative Learning." For business simulators, see CapsimInbox.)

By design, CapsimGlobal looks like its siblings. Our simulations use similar scenarios, report layouts, interfaces, charts, etc. For example, all of our simulations are set in a "sensor" industry, albeit not the same sensor industry. Industries have lifecycles. We set Foundation and CapsimCore in an early growth stage. Capstone is set in the late growth stage for a domestic evolution. CapsimGlobal is set in the growth stage for a multi-national company. GlobalDNA takes the company to a transnational level. Each simulation varies the sensor industry, learning objectives, and mission.

Instructors familiar with any of our simulations feel at home with CapsimGlobal. The controls are the same. It is easy to find information. But the application and teaching goals are tailored to different skill levels and purposes.

When students play our simulations in sequence - CapsimCore, Foundation, Capstone, CapsimGlobal, GlobalDNA - students recognize that they are building upon their earlier skill set. They approach the more sophisticated simulation with confidence and a desire to dig deeper into the content.

With this background, let's compare CapsimGlobal with its closest siblings, Capstone and GlobalDNA.

Differences with Sibling Simulations

Let's contrast Capstone, CapsimGlobal, and GlobalDNA. Respectively they reflect Domestic, Multinational, and Transnational playing fields.

Capstone presents:

- Domestic strategic alternatives. Five market segments, six generic strategies, a thorough exploration of strategic principles.

- Many opportunities to develop different types of competitive advantage.

- Case modules to expand upon strategic themes ranging from community involvement to technological surprise.

CapsimGlobal presents:

- A domestic starting position, two market segments and two new wide-open geographic markets - Germany and China.

- The company is evolving from a domestic player to a multinational player.

- Fewer opportunities to develop generic competitive advantages, but new opportunities to develop international advantages.

- Multinational issues like currency exchange and market entry.

GlobalDNA presents:

- A multinational exporter starting position, two market segments, three geographic regions - Americas, Europe, and Asia.

- The company is evolving from a multinational to a transnational player.

- Fewer opportunities to develop generic competitive advantages, but many opportunities to develop global advantages.

- Outsourcing, supply chain, tariff, exchange rate, and pricing issues that apply to a transnational corporation.

Play times for all three simulations are roughly the same, assuming players start with appropriate skillsets. GlobalDNA expects more sophisticated players than Capstone. As a benchmark, if students have played Capstone already, then they will spend a similar amount of time with CapsimGlobal and GlobalDNA because their learning curve will not require a background in generic strategies. If they have not developed an understanding of business strategy, then they must go up two learning curves - generic strategy and international strategy, and you should allocate more time.

Deep Dive

Let's dive into CapsimGlobal from an instructor's perspective. There are five topics to consider:

- The Scenario

- Cross-functional and Case Modules

- Market Segmentation and the Perceptual Map

- Generic Strategies Driven by the Perceptual Map

- International Strategies

- Competitive Advantage

The Scenario

CapsimGlobal is set in a hypothetical genetic testing device manufacturing industry. As a teaching platform, we want a scenario that students can grasp quickly, yet maps easily onto other industries.

We use a "genetic testing device" because its purpose is easily understood, and it is enough like a “widget” that students do not bring preconceived ideas about the product or customers to the simulation. With real-world products, students research the host industry in the hope of adopting a real-world strategy that is likely not present in the simulation anyway. In CapsimGlobal students ask questions like, “What do customers want from our products?”, instead of assuming they already know what customers want.

We use manufacturing because students can relate to making and marketing physical goods. We focus upon capacity utilization and productivity through technology, which applies to any business, from retail to services. We do not delve deeply into manufacturing processes. The simulation platform was designed to easily map onto other industries, and past variants of our simulations have been used to model businesses ranging from retail to service industries.

Companies are split into three functional areas - marketing, production, and finance. Decisions are set at the policy level. For example, within marketing, product prices are the average annual price, without pricing tactics like discounts or coupons that would apply to shorter time scales. Students set promotion and sales budgets, which in the real world would be allocated to various advertising campaigns and distribution methods. Rounds cover one “year” and are reported annually.

Students are told that a monopoly has just been broken up by the government into identical companies - facilities, product lines, and workforces. Their team has been hired to manage one of these new companies. Their company looks good on paper, but in truth the monopoly masked problems in product design, customer awareness, workforce, and a host of other areas.

Four industry characteristics force teams to act. They are:

- Competition. The old monopoly masked many problems. Fixing them can lead to competitive advantages. Neglecting them risks being outpaced by proactive competitors.

- Industry growth. The scenario is set during the industry life-cycle’s growth phase. However, the two segments within the market grow at different rates. Teams must invest to keep up with growing demand. Teams that can capture the growth marginalize teams that cannot.

- Changing technology. Customers expect devices to become faster and more accurate as time passes, like many electronic products.

- International market entry. Teams can enter two new countries - Germany, China, or both. Germany is roughly 1/5th the size of the domestic market, and China is roughly 1/8th. Although smaller, both are growing at 2 to 3 times the domestic rate and present no competition.

Cross-functional and Add-in Case Modules

CapsimGlobal excels at highlighting "strategic alignment". Business strategies seek competitive advantages. Often these appear in a single functional area. For example, marketing might develop brand awareness, thereby increasing demand. However, if production cannot fill the increased demand, the advantage is squandered - aka "strategic misalignment".

In CapsimGlobal , functions are clearly defined for students, and some natural coordination between functional areas must occur. For example, if the team buys production capacity, they should raise the money to fund the purchase.

However, CapsimGlobal utilizes cross-functional modules that affect all three functional areas at once. Students must think through their implications for each functional area to align them strategically. These modules include:

- R&D. Built into the scenario. Teams can update and reposition products to match customer needs. They can invent entirely new products. Inventing a product also means developing a marketing plan, a production plan, raising working capital for implementation, and raising long term capital to buy production facilities. Repositioning a product, particularly to different segment, has similar implications.

- TQM. Optional. Teams can invest in a variety of projects with outcomes that range from reduced costs to increased demand.

- HR. Optional. Teams can invest in HR programs to develop workforce competencies in each of the functional areas.

Case modules focus on a particular strategic problem. All are optional, and they are scheduled later in the simulation after teams have addressed their starting problems and developed a coherent strategy. Most have cross-functional implications. They insert dilemmas like, "We spent years getting our house in order, and while this is an attractive opportunity, it would require us to overhaul some of the things we worked hard to achieve." Case modules include:

- Community Involvement Initiatives. This case module examines the costs and benefits of local engagement. Companies can build relationships with the community by investing in up to six initiatives - health, consumption, media, scholarships, infrastructure, and employment. Outcomes cover a spectrum of measurable impacts that reduce costs and/or increase demand.

- Internet of Things. Teams add a new dimension to their products - the ability to connect to a cloud-based platform for data collection and exchange. The theme is technological convergence. Outcomes include increased unit costs, longer R&D cycle times, but potentially much higher demand,

- Technology Licensing. This case module explores licensing technology from external sources. Licensing a technology is primarily an internal matter. Customers are indifferent to the technology except to the degree to which it might affect price. Payoffs include streamlined business operations, reduced material costs, and faster R&D cycle times.

- Management Consulting. This case module looks at using external expertise to address a range of opportunities - acquisitions, technology licensing, digital marketing, and patent infringement. Teams can invest in four initiatives - synergies, licensing, digital marketing, and intellectual property. Payoffs are varied and include reduced administrative costs, reduced R&D cycle times, improved productivity, reduced inventory carry costs, and increased demand.

- Basic and Applied R&D. This case module explores fundamental advances in technology. This differs from product development, which can be thought of as taking existing off-the-shelf technology and configuring it into products that customers need. Basic and applied R&D addresses what is on the shelf to begin with. It mitigates against the risk of technological surprise. Payoffs include reduced R&D cycle time, decreased material costs, increased admin costs, and demand improvements.

- Local Suppliers. This case module explores trade-offs between distant and local supply chains. As a generalization, distant suppliers promise lower costs and features that cannot be obtained locally, but there are risks to relying upon long supply chains – integration, quality control, turnaround, temporary interruptions, etc. These risks can be mitigated through local suppliers. Consequences include higher local demand, higher unit costs, longer R&D cycle times, and reduced admin costs.

Instructors usually start CapsimGlobal with the basic scenario, then, time permitting, add HR, TQM, and case modules as the competition unfolds. They adjust CapsimGlobal's complexity to fit their audience, and they level-up the difficulty as the marketplace evolves.

Market Segmentation and the Perceptual Map

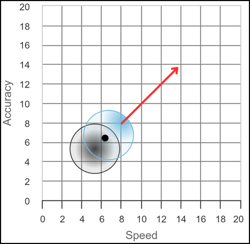

Customers are split into two market segments - Low Tech and High Tech. The segments are plotted on a perceptual map as circles. The segments begin in the lower left of the map. As the years pass, they drift towards the upper right while spreading out. Teams must update their products, invent replacements, or face obsolescence.

Customers are split into two market segments - Low Tech and High Tech. The segments are plotted on a perceptual map as circles. The segments begin in the lower left of the map. As the years pass, they drift towards the upper right while spreading out. Teams must update their products, invent replacements, or face obsolescence.

The perceptual map reminds players of board games like chess. Notice the black dot - it represents the company's starting product, which presently serves all customers. The shaded areas represent the segment's customer concentrations. In the blue High Tech segment, customers concentrate near the cutting edge of technology. In the grey Low Tech segment customers are in the middle of the segment. We can see that our product at the black dot pleases neither segment.

The map is in constant motion as the segments drift towards the upper right. Our product will be well positioned for Low Tech customers if we just wait, but if we do not reposition our product, then every day High Tech customers are less happy.

Generic Strategies Driven by the Perceptual Map

We use the perceptual map to outline five generic strategies for students during the introduction. They are:

Broad Differentiator - Both segments, emphasizing customer satisfaction. The orange stars represent future products. Because new products require their own production facilities, this strategy invests heavily in capacity.

Broad Cost Leader - both segments, emphasizing cost leadership. Because this strategy relies upon a cost advantage, it invests heavily in automation.

Niche Differentiator - Focus on dominating the High Tech segment at the cutting edge of technology. We label it "differentiator" because this segment responds to differentiation tactics more than cost leadership tactics. The High Tech segment is small but fast growing. This strategy requires capacity investments.

Niche Cost Leader - Focus on dominating the Low Tech segment. It is most responsive to cost leadership tactics. The segment is larger but slower growing. This strategy requires automation investments.

Product Life Cycle - Invent products in High Tech eventually become Low Tech as the industry matures. This strategy starts products with limited capacity and automates as the products mature.

In practice, any of these strategies can "win". Success depends upon execution. The starting position - a strategically misaligned set of identical companies - is unstable and chaotic. It is a perfect environment for teaching business strategy and developing business acumen.

International Strategies

As CapsimGlobal opens, the company can be characterized as an "active exporter". Its operations are entirely domestic, but it has developed distributors in various locations around the globe, and it engages in limited promotion and sales activities from its domestic offices. But two countries stand out as candidates for a serious effort to become a multinational corporation - Germany and China. The German market is about 18% the size of the US, growing at 28% annually. Chinese market is only 12% the size of the US market, but growing at a blistering 40% annually.

In round 1, teams have the option to keep their production facilities in the US, or to move them to either Germany or China, but they will have one production facility to serve their markets for the rest of the simulation. Moving affects shipping costs, labor costs, tariffs, and defect rates.

Opening operations in either Germany or China implies building a subsidiary headquarters there for marketing, warehousing and distribution, with the expected consequences for administrative and inventory carry costs.

From a strategic perspective the international issues include first mover advantage, investment priorities, and timing. Teams have finite resources. They are inheriting a company that is misaligned internally. Their domestic problems are significant. They could consume all of the capital they can raise on their domestic strategy - new products, investments in automation, etc. But that would mean offering Germany and China to their competitors. If a competitor enters these markets early, they can erect barriers to entry that will make these opportunities less attractive in the future.

Competitive Advantage

Conceiving a strategy is easy. Execution is difficult. Strategy revolves around developing competitive advantages. Here is a list of potential advantages that teams can develop.

- Product line: Positioning, product extenders.

- Awareness: Making customers aware of the product and its benefits.

- Accessibility: Making it easy for customers to shop, take delivery, and get support.

- Capacity: Having sufficient production capacity to meet demand without waste or idle capacity.

- Automation: Driving down labor costs through automation.

- Material cost: Reduce the cost of materials through sourcing, R&D, and design choices.

- Financial Structure: Aligning capital investments with market opportunities.

- Demand: Invest in initiatives that are force multipliers for demand.

- Process improvements: Invest in initiatives to reduce admin costs, improve productivity, and remove bottlenecks.

- R&D Cycle Time: Bring revisions and new products to market faster.

- HR: Developing a robust, flexible, highly trained workforce.

- Quality improvements: Initiatives to reduce waste, improve customer satisfaction, and improve efficiencies.

- First mover advantage: Enter Germany and China early to signal intentions to competitors.

- Erect barriers to entry: Build barriers via awareness, accessibility, and product extenders to dissuade competitors from following.

Intrinsically, CapsimGlobal is more complex than Capstone. If the instructor's goal is to make distinctions between differentiation and cost leadership, niche strategies, product lifecycles, industry lifecycles, plus additional issues raised by the case modules, Capstone is the better choice. Capstone plays out on a two-dimensional playing field, and it is easier for students to grasp these concepts. If the instructor's goals include first mover advantage, barriers to entry, and international issues ranging from currency exchange rates to tariffs, CapsimGlobal is the better choice.

Sample Agendas

CapsimGlobal is delivered in corporate seminars and collegiate classes, and in on-site, online, and blended environments. Our CRCs (customer relationship consultants) are adept at helping instructors design and plan agendas, and here are a few examples. (For a complete description of all types of deliveries, see "How to Deliver a Simulation.")

Let's begin with a seminar that blends on-site and online. The on-site component looks like an ordinary seminar. It can occur at the beginning, the end, or in the case below, both. At Capsim we love blended deliveries. They offer the best features of both environments. In this example the online component uses synchronous class meetings with virtual team breakout rooms designed by each team. The instructor visits teams in their breakouts to coach. However, rounds 3-7 could easily be asynchronous, with teams scheduling their own meetings and coaching appointments.

On-Site Simulation Kickoff

08:00Introduction & Lecture

09:00Team Analysis Exercise

10:00Practice Round

11:30End On-Site Introduction.

Online Sessions Begin

Session 1

08:00Introduction to Virtual Component

08:30Create Virtual Team HQs

09:00Debrief Practice Round and Intro Round 1

09:30Round 1 Begins. Instructor support until 11:00.

11:00Session Ends. Decisions Due midnight before next session.

Session 2

08:00Debrief Round 1. Intro HR Module.

08:30Round 2 begins. Instructor support until 10:00.

10:00Session 2 ends. Decisions due midnight before session 3.

Session 3

08:00Debrief Round 2. Intro TQM Module.

08:30Round 3 begins. Instructor support until 10:00.

10:00Session 3 ends. Decisions due before session 3.

Sessions 3-7

08:00Sessions begin with synchronous debrief and module introductions.

08:30Teams make decisions while instructor coaches.

10:00Session 3 ends, but teams can continue working until deadline.

On-Site Wrap-up

08:00Round 7 Debrief and Presentation Instructions

08:30Round 8

09:30Decisions Due. Presentation prep begins.

10:15Presentations begin.

11:30Final Debrief. Awards.

12:00Simulation seminar ends.

The next agenda presents a traditional, on-site business acumen seminar for professionals and middle managers without a business degree. We need to incorporate time for debriefs and mini-lectures on topics like competitive advantage and performance measures. In seminars like these, an ideal environment keeps teams in the same room, including breaks, working lunches, etc. The instructor works the room looking for the magical "teachable moment".

Day 1

8:00Introduction and Lecture

09:00Practice Round

10:00Debrief and Lecture

10:30Round 1

12:30Working lunch

01:00Debrief Round 1

01:30Round 2

03:00Debrief Round 2

03:30Round 3

05:00End Day 1

Day 2

08:00Debrief Round 3

08:30Round 4

10:00Debrief Round 4 and Lecture

10:30Round 4

12:00Working Lunch

12:30Debrief Round 4

01:00Round 5

02:30Presentation preparation

03:00Presentations

04:00Debrief Round 5

04:30Wrap-up

05:00Seminar ends

Finally, let's look at an academic, semester-long, on-site agenda. Our audience might be undergraduate seniors or second year MBA students. This agenda assumes a leisurely pace, but more compressed module or quarter-based agendas are easily accomodated - if CapsimGlobal can be delivered in a two-day seminar, it can be delivered in any collegiate environment. Most academic campuses today support blended learning, and we heartily recommend it. Completely online courses work well in the hands of a seasoned instructors, but for first-time deliveries, we recommend using our CRCs for your planning and setup, as today's technologies present golden opportunities (AI, recorded debriefs, team meetings, etc.) that require familiarization.

Week

1Introduction and Situation Analysis.

2Practice Round 1.

3Debrief. Practice Round 2.

4Debrief. Practice Round 3.

5Debrief. Practice Round 4.

6Debrief. Competition begins. Round 1.

7Debrief. Round 2.

8Debrief. Round 3.

9Debrief. Round 4.

10Debrief. Round 5.

11Debrief. Round 6.

12 Debrief. Round 7.

13Debrief. Round 8. Wrap-up.

Tournaments vs Footraces

Instructors can set their class up in two competition styles - tournaments or footraces. To understand the tradeoffs, we must consider company types, team sizes, and industry configurations.

Company types. A company is, of course, the business entity, but they come in two types - human and automated. Human teams want to compete with other human teams, but automated companies provide the instructor with several useful options. Automated companies can:

- Flesh out an industry when the class is small.

- Serve as a strawman during a debrief.

- Play one of the known generic strategies.

- Play at a weak, average, or strong skill level.

Team size. The instructor will split the class into teams. Small teams do not offer much diversity of opinion. Large teams risk fragmenting into factions. Experienced professors will set team size at four, five, and six participants. Teams of three and seven participants work but require a bit more coaching. Teams of two are possible in a pinch. Teams of eight or more should be avoided unless the instructor has a behavioral agenda in mind that requires large groups.

Industry configurations. Foundation Version 1 limits industries to six companies. Foundation Version 2 can expand industry size to ten companies. The more companies in an industry, the more difficult it is for human teams to do competitor analysis. For this reason, nearly all instructors set industry size between four and six companies. Indeed, a majority of instructors will set up their industries with exactly six companies, using automated companies to flesh out smaller classes. This works fine for classes with up to 42 participants - six teams of seven participants.

But what about larger classes? Instructors can opt for two or more industries, but each industry needs a debrief. Usually, the time available for debriefs is limited, and splitting that time between industries reduces the quality of the feedback. Foundation Version 2 configured with ten teams expands the class size to 70 participants, and most instructors will choose that over two industries. When there are more than 70 participants, the lead instructor will either employ junior instructors or structure a footrace.

Tournaments. A tournament pits companies against companies in a free for all. Companies start at identical positions. (“The government just broke up a monopoly.”) Students love tournaments. They engage all of the senses in a highly charged emotional environment, and that anchors the learning. They are fun to teach.

Tournaments. A tournament pits companies against companies in a free for all. Companies start at identical positions. (“The government just broke up a monopoly.”) Students love tournaments. They engage all of the senses in a highly charged emotional environment, and that anchors the learning. They are fun to teach.

Most tournaments consist of one industry. In practice 90%+ of classes are below the 42 student threshold - six teams of seven participants. Here are a few examples:

- 8 participants. Two teams, four automated companies.

- 12 participants. Three teams, three automated companies. Or four teams of three, and zero to two automated companies.

- 30 participants. Five teams of six players, one automated company. Or six teams of five players.

- 42 participants. Six teams of seven players.

- 48 participants. Eight teams of six players.

- 70 participants. Ten teams of seven players.

Footrace. Footrace editions automate each team’s competitors. The industry consists of a human team and five automated companies playing five distinct strategies. Teams compare their results across identical industries.

Footrace. Footrace editions automate each team’s competitors. The industry consists of a human team and five automated companies playing five distinct strategies. Teams compare their results across identical industries.

The automated companies within each industry always play the same strategies. For example, the "B" or Baldwin Company always plays the same generic strategy. The debrief can draw teaching points about an automated company and know that it applies to all human teams.

Footraces are not quite as emotionally charged as a tournament, but the competitive elements are still in place. Students compare performance measures across the entire class.

Footraces are often employed for large events and competitions. For example, at the end of each semester Capsim offers a Capsim Challenge to currently enrolled students. Upwards of 1000 individuals and teams compete in a footrace. The top six qualify for a tournament to declare an overall winner.

Delivery Steps

CapsimGlobal is a Software as a Service (SAAS) product, meaning that processing occurs in a secure, online, 24/7/365 environment. It is delivered in both seminar and academic venues, and in live, blended, and online environments.

For an all-encompassing discussion of deliveries, see “Delivering a Business Simulation”. Here we will focus on CapsimGlobal alone.

Registration. Students need to be able to identify teammates and competitors on the website and reports, so it is important to register all students.

- Students are either bulk registered before the simulation begins, or they self-register with a coupon (a “registration number”) or a credit card.

- We recommend providing students with registration or login instructions before the simulation begins either in email or a syllabus.

Onboarding. In seminars instructors usually do a hands-on introduction and practice round, although online materials are available for pre-work.

For traditional classes the onboarding materials make delivery and scheduling extraordinarily flexible, and they reduce the instructor burden by automating routine tasks like team formation. Students are provided with a comprehensive online onboarding package that includes a variety of resources - videos, tutorials, demonstrations, quizzes, and practical exercises.

When students log in, their first menu item is “Getting Started”. Assign those items that you want students to do before your introduction. They include:

- An Introductory Lesson (video) and quiz.

- The Team Member Guide (booklet describing scenario and rules)

- The Industry Conditions report (parameters specific to this simulation)

- Rehearsal Tutorial (walks students through the decision support software)

- The Reports (The reports for the starting round)

- Join a company (if they are self-registering)

- Situation Analysis

- Pick a strategy (an overview of the generic strategies)

- Add-in modules and case modules (describes options selected for this iteration.)

Students should take advantage of the same resources they have on the job, including AI and social media. During the introduction, we suggest that instructors:

- Demonstrate an AI by asking it a few questions relevant to the simulation.

- Play at least one YouTube video about the simulation that some student somewhere has posted.

- Demo a search for opinions and advice on Reddit or other social media platforms about how to win the simulation.

We want students to seek out any competitive advantages they can find. It will not harm the learning environment; it will enhance it. For perspective, consider sports. Will teams research, watch videos, or seek opinions before a game? In seminars that Capsim delivers, we make two points about winning. First, it is a matter of degree. If Team A achieves cumulative profits of $43 million, and Team B achieves $42 million, it would not matter in the real world, and it only matters in the seminar because we award coveted coffee cups as a prize to the "winning" team. Second, suppose that an AI recommends teams adopt, say, the "Broad Cost Leader" strategy. If five of six teams follow the AI's advice faithfully, the sixth team will win, because it did something different while the other five arbitraged away their competitive advantages. Execution matters, and that is a dance with competitors and the marketplace that begins in the first round.

Of course, we like to think that students can find answers to any question on the Capsim website. We routinely scour the Internet looking for good ideas that we can pass along. But we want students to research. Perhaps an external opinion will trigger a response in the student. Good advice? Bad advice? There is plenty of both online. We want participants to think, to angst, to experiment, and to argue a perspective with their teammates.

What matters is how the team responds to their industry as it evolves. So long as all teams have the same information resources, the competition will be fair and meaningful.

Introductory lecture. 0-60 minutes. Tailored to the audience. In principle, Getting Started can onboard students independently. In practice, students expect some form of instructor interaction as the simulation begins.

Team Analysis Exercise. 60 minutes. Recommended but not required. The exercise serves two purposes - team building and team comprehension of the business issues they face. It explores the simulation parameters while people take the measure of their teammates. Variations on the assignment ask each student to analyze a product, a segment, or a functional area, then report their findings to the team. We recommend a team building instrument like TeamMATE with this exercise.

Rounds. 60-150 minutes. Allow more time for early rounds, less for later rounds unless you insert case modules. The basic simulation block is a decision round, which covers one year of simulated time. A round begins with a debrief, usually instructor led, that presents the starting situation or the results from the previous round. Teams meet to make decisions. At the deadline, the simulation processes under manual or automatic control. At the instructor’s whim, students can access results immediately or wait for the debrief.

- Practice Rounds. Strictly speaking practice rounds are optional. The first practice round familiarizes teams with the rules and process. The second lets them experience the consequences of actions they took in the first round. Practice rounds three and four provide time to introduce optional modules or add-ins

- Competition Rounds. Instructors can schedule up to eight competition rounds. Instructors can increase the complexity as the simulation evolves by adding in optional modules and add-ins, typically one per round. Modules offer opportunities to create competitive advantage. However, these take time to develop before reaping benefits. Ideally add 2-4 rounds beyond the last optional module. Add-ins explore themes within business.

Debriefs. As much for dramatic effect as for analysis, teams want their instructor to announce results to the class and make observations about the industry’s evolution. Debriefs are also used to introduce new modules and add-ins.

Additionally, students can self-debrief using online reports and tools available on the website.

Team Presentations. In “backdrop” applications, team presentations are optional. In “integration” applications, expect that students will want to talk about their experiences, their mistakes and successes, and what they have learned.

Communication with stakeholders is one of CapsimGlobal's learning objectives. Students want to talk about their experiences, their mistakes and successes, and what they have learned.

- We recommend that teams use an AI presentation software platform (several are free), and that they begin writing slides in competition round 1 to capture high points during the simulation.

- Live seminars are time constrained. Teams have 30 minutes to create their presentation. Worst case, teams fill out a canned slideshow that covers the important learning points and performance outcomes. Limit delivery time to 10 minutes per team.

- Online and blended environments have the luxury of time, which lends itself to creativity. Perhaps you can entice local businesspeople to sit on a “board of directors” that asks teams questions about their strategy and tactics. Or perhaps teams can pitch their company to a virtual “shark tank”. In all cases teams must cover the important business topics, which generally reinforce the learning objectives. Expect 10-15 minutes per team presentation.

Final Debrief. 5-30 minutes. Teams want to know, “Who won, and how did we do?” CapsimGlobal offers two scoring methods, the Balanced Scorecard, and for instructors wishing to emphasize the performance measure learning objectives, a nuanced methodology for allowing teams to select their own performance measures. The final debrief looks at the last round’s results, then rank orders the teams to declare an overall winner.

Support

Capsim has been training instructors that are new to simulations for over 25 years. Our Customer Relationship Group can provide you with sample schedules, syllabi, slide shows, assignments - any materials you need to succeed in the classroom.

We routinely go over simulation results with new instructors before their debrief. We can shadow you online during your first deliveries.

We take questions from students by email and by scheduled call.

Often new instructors are specialists, not generalists. They are not comfortable teaching materials outside their specialty. No problem. From our perspective, we hear the same questions from students class after class. We go over those questions with you. Our goal is to make your teaching experience routine.

If you are in a corporate environment and plan to deliver a few seminars and then stop, chances are failure-is-not-an-option. No problem. Capsim can provide experienced, talented instructors drawn from planet Earth’s finest schools.

We also provide on-demand facilitators drawn from our CRC department, the same people that train-the-trainer. Facilitators insure that your seminar is free from technical challenges and that instructors can concentrate on teaching instead of logistics.

Large event? Capsim has delivered events with upwards of 1000 people. We can work with you at every stage, from planning to clean-up.

- Professor/Instructor Train-the-trainer

- Sample Syllabi and Tailoring

- Course Design and Setup

- Student Assistance

- Product Walk-throughs and Demos

- Event Planning

- Pre-debrief Consulting

- Bulk Registration

- On-site/online Faculty and Facilitators

- Plug-in Module Development